Nvidia to Lease Data Center Funded by $3.8 Billion of Junk Bonds

Advertisement Space - Below Article Title

Advertisement Space - In-Article Ad

Original Source:

Read full article at sourceAdvertisement Space - End of Article

Advertisement Space - Below Article Title

Advertisement Space - In-Article Ad

Original Source:

Read full article at sourceAdvertisement Space - End of Article

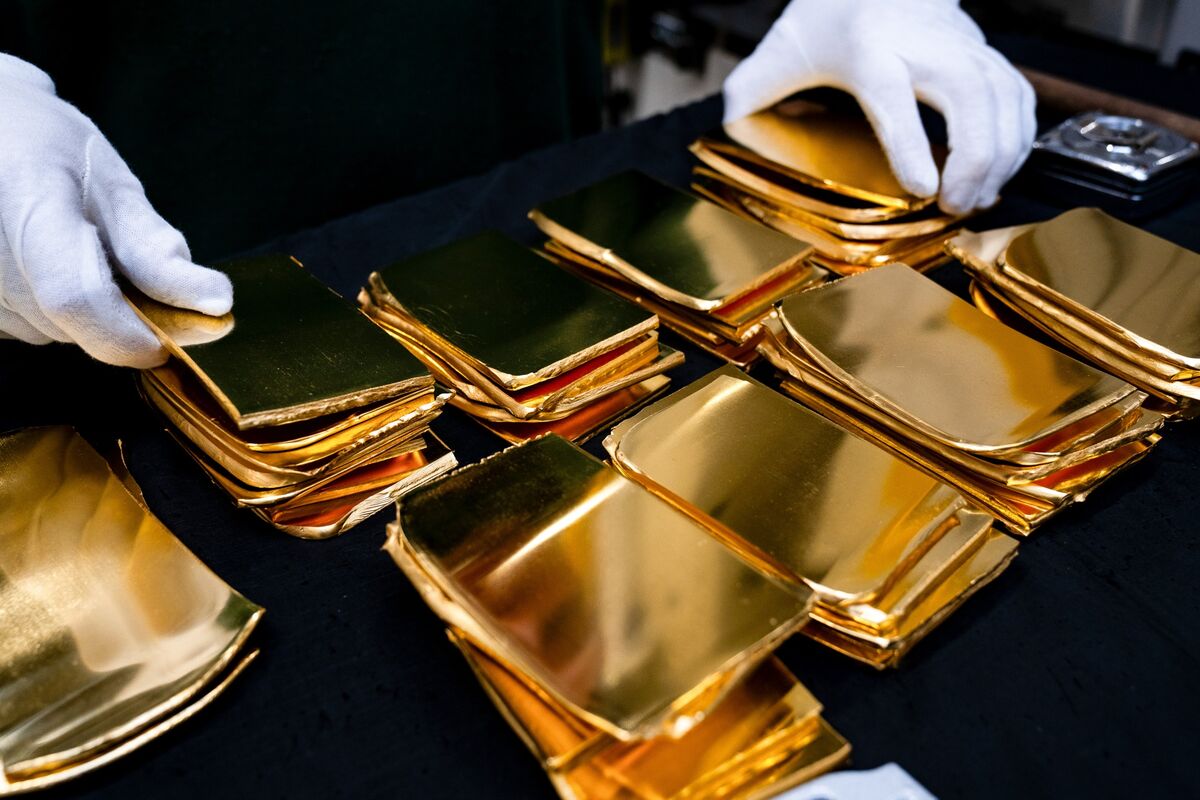

Gold steadied after a sharp decline sparked by a wider selloff across financial markets.

Steve Moore, Co-Founder of Unleash Prosperity and a former Trump Economic Adviser, joins Bloomberg Businessweek Daily to discuss the state of the US economy as the second year of President Trump's second term begins, Trump's pick for the next Federal Reserve Chair Kevin Warsh, current trade policy, and more. Moore also weighs in on a Bloomberg report that Trump is weighing quitting the USMCA trade pact he negotiated during his first term. Moore says both the USMCA and NAFTA trade agreements are beneficial, saying that the USMCA agreement in particular is "enormously advantageous to the whole North American continent." Moore speaks with Carol Massar and Tim Stenovec, alongside Bloomberg Economics US and Canada Economist Stuart Paul. (Source: Bloomberg)

Clear Street Group Inc., a Wall Street broker built on cloud computing technology, has postponed its US initial public offering after cutting the target by nearly two thirds.

Humana Inc. is in advanced talks to acquire MaxHealth in a deal valuing the operator of primary care clinics at about $1 billion, according to people familiar with the matter.

One strategist said the currencies have "undoubtedly lost some of their sheen," while others warned of more volatility ahead.

US bond investors poured another $4.3 billion of cash into high-grade bond funds in the week ended Wednesday, the eleventh consecutive week of inflows, according to LSEG Lipper, as investors scramble to buy debt still offering decent yields.